FIND YOUR NEW HOME

Buying a home can be a stressful process for you and your family. My goal is to minimize the stress you will encounter from getting pre-qualified for a mortgage to handing you your keys on closing day. I am committed to excellence and service and guarantee a solid, open line of communication and rapid response always.

CALL OR EMAIL ME

For 4/26/2025

30 Year Fixed |

6.875% |

15 Year Fixed |

6.25% |

7/6 ARM |

7.125% |

For general informational purposes only. Actual rates available to you will depend on many factors including lender, income, credit, location, and property value. Contact a mortgage broker to find out what programs are available to you.

Mortgage calculator estimates are provided by C21 North Homes Realty and are intended for information use only. Your payments may be higher or lower and all loans are subject to credit approval.

SEARCH

LENDING

I have a list of local lenders that I can connect you to, that can get you pre-qualified for us to go shopping for your new home. Not all lenders are the same, and I can help you determine the best fit for your needs, including those that have assistance programs to help with closing costs and competitive loan rates.

Here are some things to expect during the lending process:

- Mortgage Consultation: It’s important that you have a mortgage consultation so you know how much you can afford before you start shopping for a home. Application: Be prepared with the required documents, including personal information and information on the property you want to purchase.

- Processing: Your loan processor will gather all the necessary loan documents. You should begin to shop for homeowners insurance and direct your chosen company to provide your processor with information about the policy.

- Underwriting: The underwriter analyzes and interprets the information in the loan package, reviews the property and your credit, orders mortgage insurance (if applicable), and assigns conditions.

- Funding and Closing: If your loan is approved, the funder orders the loan documents, the borrower signs the docs (which are then re-verified), final conditions are satisfied, the funds are requested and title is passed from the seller to the borrower(s). Congratulations on the purchase of your new home!

Smart Tips During Home Buying – Here are some things to avoid:

- Changing jobs, becoming self employed, or quitting your job.

- Making any large purchase.

- Using charge cards excessively or making late payments.

- Spending money you have set aside for closing costs.

- Omitting debts or liabilities from your loan application.

- Making large deposits without first checking with your advisor.

- Changing bank accounts.

- Co-signing a loan for anyone.

WORKING WITH ME

When you work with me, you will:

- Be more likely to find the home that meets all your criteria

- Lessen the amount of time it will take to find your home

- Understand all the terms, processes and documents used when buying your home

- Have up-to-date market information that will allow you to make informed decisions

- Have a skilled negotiator working on your behalf, one who is committed to looking after your best interests

- Enjoy peace of mind, knowing that all the details of your purchase are being taken care of by an experienced and knowledgeable professional

DOWNLOADS

Here are some useful downloads:

- CENTURY 21 Buyers Real Estate Service Plan - What to expect by hiring me to represent you as a buyer - including my Service Pledge.

- New Buyer Questionaire – The first step in sharing with me what you are looking for in your new home.

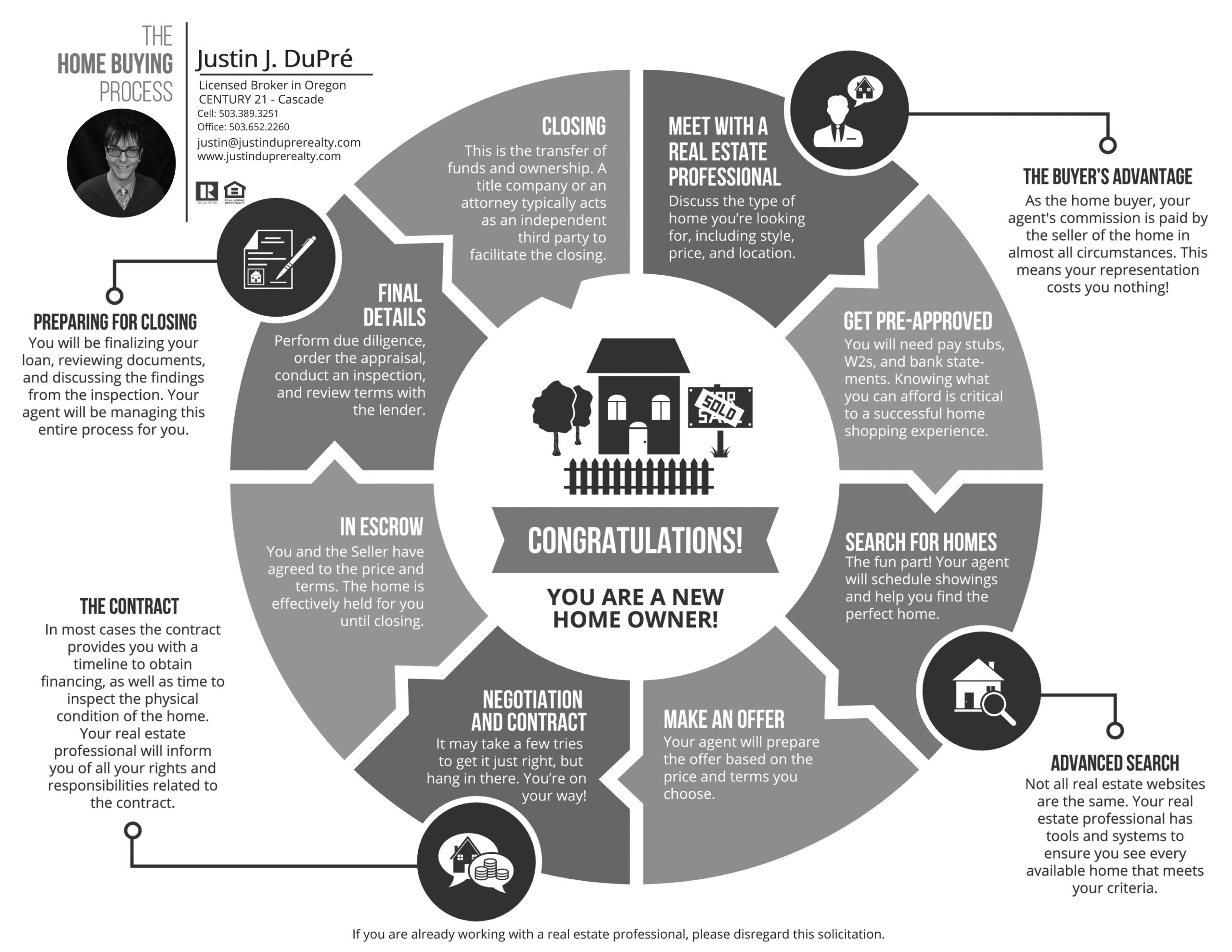

- The Home Buying Roadmap – Steps involved in the buying process.

- House Hunting Checklist – Take this with you to any open house, fill out and send back to me.

- Real Estate Terminology – A list of common terms in real estate.

- Complete Buyer’s Packet – Everything consolidated into one convenient packet.

RATES

For 4/26/2025

30 Year Fixed |

6.875% |

15 Year Fixed |

6.25% |

7/6 ARM |

7.125% |

For general informational purposes only. Actual rates available to you will depend on many factors including lender, income, credit, location, and property value. Contact a mortgage broker to find out what programs are available to you.

Mortgage calculator estimates are provided by C21 North Homes Realty and are intended for information use only. Your payments may be higher or lower and all loans are subject to credit approval.